Your Savings & Comfort Await!

Attic Insulation

Retrofitting attics is the best “Bang for your Buck”. Most of the heat loss or gain occurs here. Blown cellulose and loose-fill blown fiberglass are the two most popular materials. We install both. The Department of Energy recommends an R49 to R60 installed in the attic. Current minimum code is an R60 in Colorado.

Do you need attic insulation?

A Warm Blanket for Your Home

Today, per code, all of Colorado requires an R60 in your attic. This is about 20 inches of insulation. Most homes built prior to 2009, have an R30 or less.

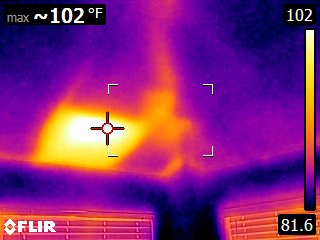

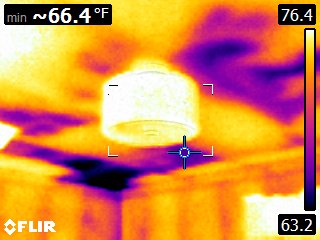

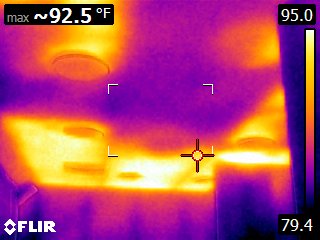

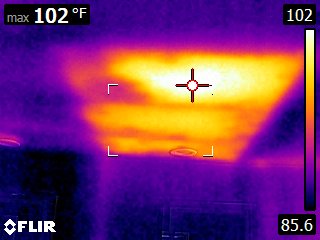

This may seem like an overabundance or an unnecessary amount of insulation. However, this is due to how hot most attics can get. On average, we will see temperatures over 170 degrees on the inside or attic side of the roof sheeting. It is very common for attics to be over 140 to 150 degrees. They’re often so hot we have to use gloves to touch the trusses as they are much like a hot pan on a stove. There has to be enough insulation to protect the interior of the home from these extreme temperatures.

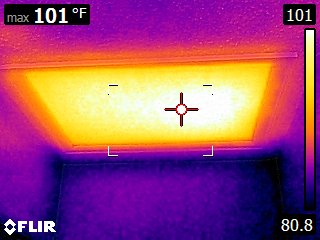

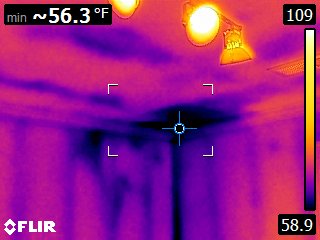

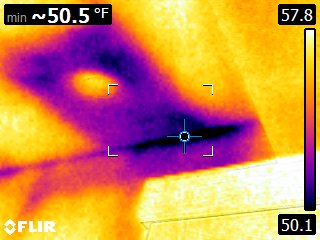

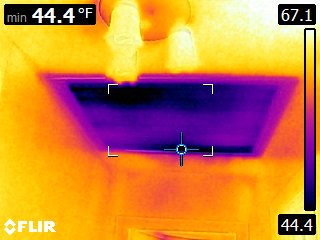

In the summer, a poorly insulated attic turns the ceilings of the home into a large heater. We can see this in the thermal camera pictures on this page. In the winter this effect reverses itself. It is very difficult for an air conditioning system or heat pump to overcome this deficiency and make the space efficient or comfortable.

New 2025 Xcel Rebates are here! Great news, rebate amounts have INCREASED! It is possible to save thousands of dollars on your project.

Insulation and Air Sealing | Residential Services | Residential Services | Xcel Energy

In addition, the federal government offers clean energy tax credits for upgrading the efficiency of your home using the IRS 5695 form.

Making Our Homes More Efficient: Clean Energy Tax Credits for Consumers | Department of Energy

Our team at NetZero Insulation can help you with any rebate or tax credit questions you may have.